How Much Money Does It Take To Buy A House

Determining how much money you need to buy a firm has ever been daunting for first-time homebuyers, but in 2021, thinking about your budget tin can feel downright maddening, with abode prices hitting new highs beyond the land. Despite the challenges of a seller'south marketplace, buying a dwelling house tin can help yous escape renting and build disinterestedness. Here's a rundown of the fundamental costs in making homeownership a reality.

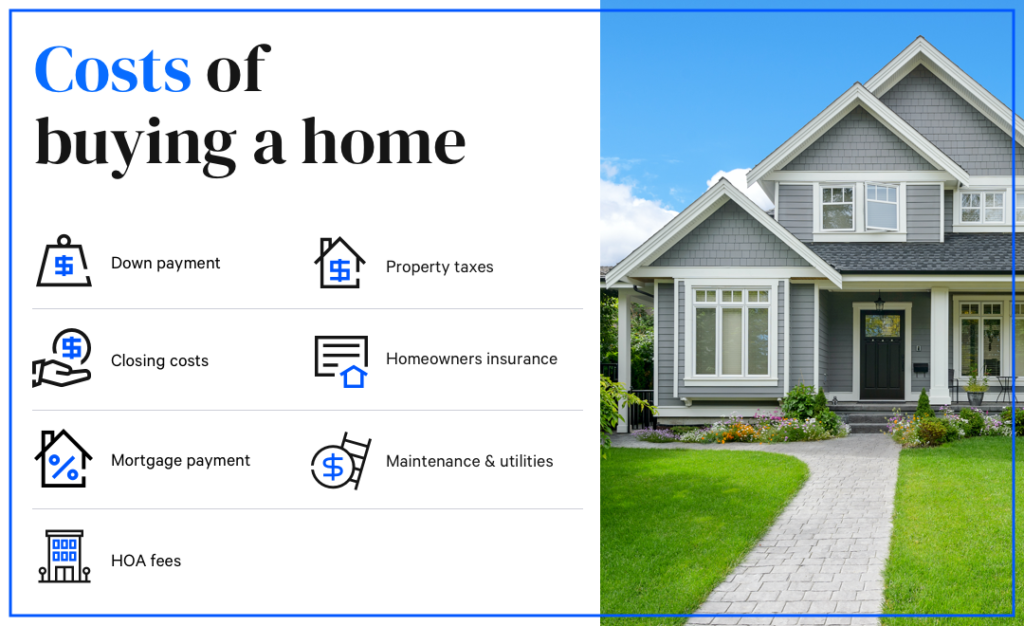

Breaking down the cost of buying a home

As you lot consider the price tag of a home, it's important to summate the three major expenses y'all'll need to cover in order to call it your own:

1. Down payment

The downwardly payment is the amount of money you lot can afford to contribute to the home buy. You'll go the most favorable mortgage rates and avert paying mortgage insurance past making a downward payment of at least 20 percent. That's considering lenders take on less take chances with borrowers who put more coin down.

With a 20 percent down payment, yous'll pay $20,000 for every $100,000 of the home's cost. For example, on a $300,000 home, a 20 percent down payment would exist $60,000.

Even so, the belief that you have to have 20 pct of the buy price is a myth. There are several low- and no-down payment mortgages out there that allow for less coin upfront. Some conventional mortgage programs backed by Fannie Mae and Freddie Mac require only three percent down. The caveat with these types of loans is that they can have income restrictions and require a higher credit score.

FHA loans require just 3.v percent down, and y'all'll demand a credit score of at least 580 to qualify. VA loans and USDA loans don't require a down payment at all, although you'll need to meet sure criteria in social club to be eligible.

Be certain to browse commencement-fourth dimension homebuyer programs in the city and land where you lot want to buy, too. Some programs offering grants or zero-interest loans for your downwards payment costs if you can meet certain low- to moderate-income requirements.

You shouldn't program to spend every penny you have to cover your down payment. A lender will evaluate your entire financial portfolio and might want to come across some greenbacks reserves that you can use to pay back your loan if you observe yourself in a tough spot. You'll also want to accept plenty set aside in an emergency fund (three to vi months' worth of expenses or more).

Regardless of how much you lot program to put down when you lot buy a dwelling, coming up with that big upfront cost requires some work. Consider these helpful tips to build your downward payment funds :

- Await for little ways to spend less . Take a wait at your spending habits, and identify every surface area where y'all can trim a few bucks. Can you cancel your cable? Are y'all overpaying for your jail cell phone service? Should you be dining out less?

- Earn interest. From CDs to high-yield savings accounts , every extra penny counts. Rather than saving in an account that pays trivial to no involvement, compare interest rates on options where y'all tin can park your money. You lot can estimate your potential earnings with Bankrate'southward compound involvement figurer. Whichever instrument you use, just be sure you lot'll have admission to the funds when you demand them. If you're planning to purchase a domicile in the next twelvemonth, for example, a savings account might exist your all-time bet.

- Ask for help. If yous have a relative or shut friend who has the money — and loves you enough to give it to y'all with no strings attached — a souvenir tin can exist used for the down payment. A lender will want reassurance that information technology is, in fact, a souvenir, so plan to submit agift letter from the friend or family member that explains yous won't need to pay it back.

2. Closing costs

Generally, you tin expect to pay two percentage to five percent of your mortgage loan principal in closing costs . In 2020, borrowers paid an average $6,087 in closing costs and taxes, according to ClosingCorp . Closing costs vary widely from state to land, however. For instance, average closing costs in New York in 2020 were $thirteen,261, but only $ane,571 in Missouri.

Closing costs include lender and 3rd-political party fees, which can include an appraisement fee , credit report fee, origination fee, application fee, title search fee, title insurance and underwriting fee.

If you don't have cash to pay for closing costs, inquire your lender nearly no-closing-cost options . Some lenders will roll the expenses into the overall loan. Simply keep in mind that doing then will cost you more in the long run, since you'll be paying interest on the additional amount.

It'southward important to note that you'll likely pay some additional expenses on closing twenty-four hour period that aren't considered closing costs. These are known as prepaids , and can include homeowners insurance premiums and property taxes. You'll also prepay involvement on any days remaining through the cease of the month. For example, if y'all close on April 20, you lot will prepay on involvement through April 30.

On elevation of endmost costs and prepaids, you'll also want to earmark money for moving expenses, piece of furniture, repairs, storage or any other costs you might encounter as you motility into your new home.

iii. Mortgage payment

Equally you're thinking almost how much money you demand to buy a house, it'south crucial to know how much it'll price you every month, not simply on closing 24-hour interval.

Your monthly mortgage payment is ane of the most predictable ongoing costs. You can use amortgage calculator to figure out how much you'll owe each month. For example, if you infringe $240,000 and finance information technology with a 30-yr, stock-still-charge per unit mortgage at 3 percent, you'd pay $1,011 in monthly principal and interest.

Your mortgage rate has big impact on your monthly mortgage payment, which makes it crucial to shop with multiple lenders for the best mortgage rate. According to aConsumer Financial Protection Bureau study , more than three-quarters of all borrowers only applied for a mortgage with 1 lender, and failing to comparison-shop could cost you thousands over the life of the loan.

In addition to paying the primary and involvement, your mortgage payment will probable include mortgage insurance if yous put less than 20 percentage down. Mortgage insurance is a protection for the lender in case you lot ever cannot pay the loan back.

If y'all have an FHA loan , you lot will virtually certainly pay mortgage insurance, which includes a premium upfront and additional premiums built into your mortgage payment. If you have a conventional loan with a downward payment less than xx pct, you'll pay private mortgage insurance (PMI) until yous take built up 20 per centum disinterestedness in the abode. While the price of PMI varies based on your credit and your loan, Freddie Mac estimates that borrowers pay an extra $30 to $70 per month for every $100,000 borrowed.

For your long-term outlook for the costs of existence a homeowner, be sure to gene in homeowners insurance, property taxes, whatever HOA fees if your property is function of an association and regular maintenance expenses. Consider budgeting for emergency home repairs and maintenance in the amount of 1 percent or more of your home'due south value every year. For example, on a $300,000 home, your upkeep for maintenance-related items would be $iii,000 annually.

How to prepare to buy a home

Once you've answered the big question of how much money you need to purchase a house, it'southward time to answer another one: how to get prepare to make the bodily purchase. Hither are some steps to take to prepare to buy a dwelling.

1. Check your credit

Mortgage lenders apply your credit score, along with other criteria, to determine your creditworthiness. You lot can get your credit score from each of the three major credit reporting agencies (Equifax, Experian and TransUnion) for costless every week from AnnualCreditReport.com through April 2022 (you tin can typically do it every twelvemonth, simply the credit agencies extended this benefit due to the pandemic).

There are also many online services at present offering credit scores for free — and your bank might offer this, as well. If your score is on the lower side, try to take steps to improve your credit earlier seeking out a mortgage.

2. Create a budget

Based on the costs listed above, create a realistic upkeep. Many experts recommend following the 28/36 percent rule , with which y'all should spend no more than than 28 percent of your gross monthly income on housing and no more 36 percent full on debt, including your housing costs.

3. Save for a down payment

You'll typically demand at least three pct of the buy price of the home as a downwardly payment. Proceed in mind that you lot'll need to put at least twenty percent downward to avoid having to pay for mortgage insurance, however.

four. Shop for a lender

Getting preapproved past a lender for a mortgage is helpful when shopping for a domicile. Not only does it make you a more serious buyer to sellers, but information technology also provides you with a better idea of how much home you tin truly afford. Start past shopping around and getting quotes from at least three lenders.

v. Be willing to compromise

While home prices are rising, that doesn't mean your budget can, likewise. Nearly one in 5 showtime-time homebuyers have had to eliminate some items on their wish list in gild to afford a belongings, co-ordinate to a recent Realtor.com survey . From being willing to give up on a garage as a must-accept to ditching the demand for a finished basement, buying a home might require yous to deal with yourself.

Bottom line

When it comes to how much money you demand to buy a house, there's much more than the listing toll to consider. Make certain to account for both upfront and ongoing expenses when creating a upkeep, and take a close wait at your monthly finances to brand sure that conveying a mortgage and paying for continuing expenses won't be a financial burden long-term.

With additional reporting by David McMillin

Learn more:

- 10 first-time homebuyer loans and programs

- First-time homebuyer mistakes to avoid

- How to observe the all-time mortgage lender as a first-time homebuyer

Source: https://www.bankrate.com/mortgages/how-much-money-do-you-need-to-buy-house/#:~:text=You'll%20get%20the%20most,%24100%2C000%20of%20the%20home's%20price.

Posted by: allenclas1974.blogspot.com

0 Response to "How Much Money Does It Take To Buy A House"

Post a Comment